Introducing the Best Credit Card Payment App for Android: A Convenient Solution for Modern Shoppers

In today's fast-paced digital world, convenience is of utmost importance, especially when it comes to managing our finances. The advent of smartphones has revolutionized the way we shop, pay bills, and make transactions. With the rise of mobile payments, having a reliable credit card payment app for Android is a must for modern shoppers.

Imagine a world where you can leave your wallet at home and pay for your purchases with just a few taps on your Android device. This is now possible with the best credit card payment app for Android, a powerful tool that combines convenience, security, and efficiency in one seamless platform.

Why Choose a Credit Card Payment App for Android?

1. Convenience: Make Payments Anytime, Anywhere

Gone are the days of carrying around stacks of cash or fumbling through your wallet to find the right credit card. With a credit card payment app for Android, you can make payments anytime, anywhere. Whether you're at a local store, shopping online, or dining out, the app allows you to complete transactions effortlessly.

By simply opening the app on your Android device, you can quickly and securely make payments with just a few taps. No need to worry about carrying physical cards or cash, as everything you need is stored conveniently within your smartphone.

2. Security: Protecting Your Personal and Financial Information

Security is a top concern for any financial transaction, and credit card payment apps for Android prioritize the protection of your personal and financial information. These apps utilize advanced encryption technology and tokenization to ensure that your sensitive data is never stored on your device or shared with merchants.

When making a payment, the app generates a unique transaction code, ensuring that your credit card details are never exposed to potential hackers or fraudsters. This added layer of security gives you peace of mind knowing that your information is safe and secure.

3. Speed and Efficiency: Streamlining the Checkout Process

Waiting in line to complete a transaction is a thing of the past with a credit card payment app for Android. These apps offer a fast and efficient way to make payments, saving you valuable time during your busy day.

By simply tapping your Android device on a compatible payment terminal, you can complete a transaction in seconds. No need to fumble through your wallet or wait for a chip card reader to process your payment. The convenience of mobile payments allows you to get in and out of stores quickly, making your shopping experience more efficient.

4. Organization and Tracking: Managing Your Finances Effectively

Keeping track of your expenses can be a daunting task, but credit card payment apps for Android simplify the process. These apps provide you with a comprehensive view of your transaction history, allowing you to easily track and categorize your expenses.

By having all your transactions recorded in one place, you can gain valuable insights into your spending habits. Some apps even allow you to set budgets, receive spending alerts, and generate reports to help you manage your finances more effectively.

The Best Credit Card Payment App for Android: Features and Benefits

There are several credit card payment apps available for Android devices, but one stands out from the rest. Let's explore the features and benefits of the best credit card payment app for Android:

1. User-Friendly Interface: Seamlessly Navigate the App

The best credit card payment app for Android offers a user-friendly interface that makes it easy for users of all backgrounds to navigate and use the platform. Whether you're a tech-savvy individual or new to mobile payments, the app's intuitive design ensures a seamless experience.

With clear menus, simple navigation, and intuitive controls, you can easily access the app's features and make payments with confidence. The user-friendly interface enhances the overall convenience of the app, making it accessible to a wide range of users.

2. Multiple Card Support: Manage All Your Cards in One Place

Managing multiple credit cards can be a hassle, but the best credit card payment app for Android allows you to add and manage multiple cards within a single platform. This eliminates the need to carry multiple physical cards and simplifies the payment process.

With just a few taps, you can switch between different cards when making a payment, ensuring that you always have the right card available. This feature saves you time and effort, as you no longer have to dig through your wallet to find the right card for each transaction.

3. Contactless Payments: Tap and Go

The best credit card payment app for Android supports contactless payments, allowing you to make transactions by simply tapping your Android device on a compatible payment terminal. This feature revolutionizes the way you make payments by providing a convenient and hygienic experience.

As contactless payments gain popularity, more merchants are equipped with the necessary payment terminals. Whether you're at a coffee shop, retail store, or even a food truck, you can quickly and securely make a payment by tapping your Android device. This eliminates the need for physical contact with payment terminals, reducing the risk of germs and promoting a safe payment experience.

4. Rewards and Offers: Get More Value From Your Transactions

Who doesn't love rewards and discounts? The best credit card payment app for Android often offers exclusive rewards, cashback, and discounts for using the app for your purchases. By taking advantage of these offers, you can save money and get more value from your transactions.

Whether it's earning points for every dollar spent or receiving personalized discounts from partner merchants, these rewards and offers enhance your overall shopping experience. You can enjoy the benefits of your favorite credit card rewards programs while enjoying the convenience of mobile payments.

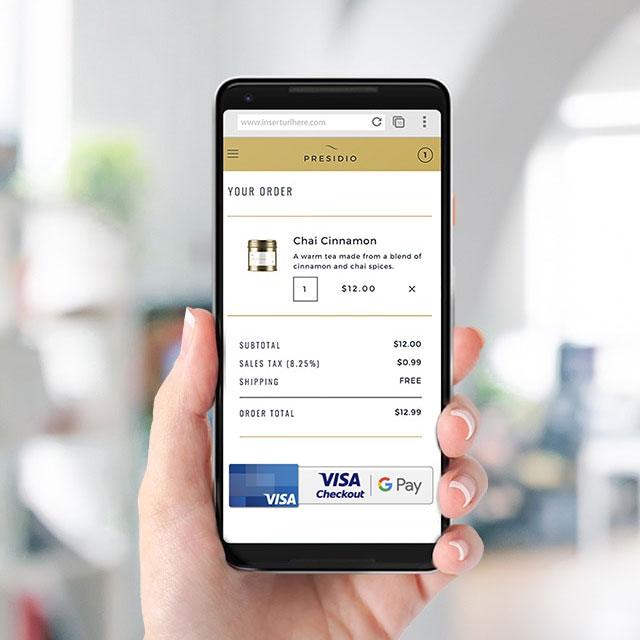

5. Integration with Digital Wallets: Consolidate Your Payment Methods

Managing multiple payment methods can be confusing, but the best credit card payment app for Android seamlessly integrates with popular digital wallets, such as Google Pay and Samsung Pay. This integration allows you to consolidate your payment methods in one place.

By linking your digital wallet to the credit card payment app, you can easily choose between different payment methods when making a transaction. Whether you prefer to pay with your credit card, debit card, or even virtual gift cards, you can do so without switching between different apps or carrying multiple physical cards.

6. Bill Splitting and Payment Reminders: Simplify Shared Expenses

Splitting bills among friends or roommates can be a hassle, but the best credit card payment app for Android simplifies the process. These apps offer features that allow you to split bills, send payment reminders, and settle outstanding balances with just a few taps.

Whether you're dining out with friends or sharing household expenses, you can easily divide the total bill among multiple individuals. The app calculates each person's share, making it easy to request payments and settle expenses without the need for cash or complicated calculations.

7. Enhanced Security Features: Protecting Your Transactions

Security is always a top priority when it comes to financial transactions, and the best credit card payment app for Android goes above and beyond to ensure the safety of your data. These apps offer enhanced security features to provide you with peace of mind.

One of the most common security features is biometric authentication, which allows you to use your fingerprint or facial recognition to access the app and authorize payments. This ensures that even if someone gains access to your device, they won't be able to make unauthorized transactions without your unique biometric data.

In addition to biometric authentication, some apps use unique transaction codes for each payment. These codes are generated in real-time and are only valid for a single transaction. This means that even if a hacker intercepts the code, they won't be able to use it for any other transaction.

8. Transaction History and Reports: Gain Insights into Your Finances

Understanding your spending habits and financial health is crucial for effective money management. The best credit card payment app for Android provides you with a comprehensive transaction history and reporting features.

You can easily review past transactions, categorize expenses, and even set budgets within the app. By analyzing your transaction history, you can identify areas where you may be overspending and make informed financial decisions. Some apps also offer the ability to generate detailed reports, allowing you to track your progress and take control of your finances.

Conclusion

In a world where convenience and efficiency are paramount, a credit card payment app for Android is an essential tool for modern shoppers. With its user-friendly interface, advanced security features, and seamless integration with digital wallets, the best credit card payment app for Android offers a convenient and secure way to make payments on the go.

Whether you're looking to simplify your shopping experience, track your expenses, or take advantage of exclusive rewards, this app has it all. Embrace the future of payments and revolutionize your financial transactions with the best credit card payment app for Android today!