Card Payment Apps for Android: A Comprehensive Guide

With the increasing popularity of digital payments, having a reliable card payment app on your Android device has become essential. Whether you are a business owner or an individual looking for a convenient and secure way to make transactions, there are numerous options available to cater to your needs. In this comprehensive guide, we will explore the best card payment apps for Android, their features, and how they can benefit you.

In this article, we will delve into various aspects of card payment apps for Android. From the top-rated apps to their key features and security measures, we will leave no stone unturned. So, whether you are a tech-savvy entrepreneur or someone who wants to simplify their day-to-day transactions, this guide will provide you with all the information you need to make an informed decision.

1. Top-rated Card Payment Apps for Android

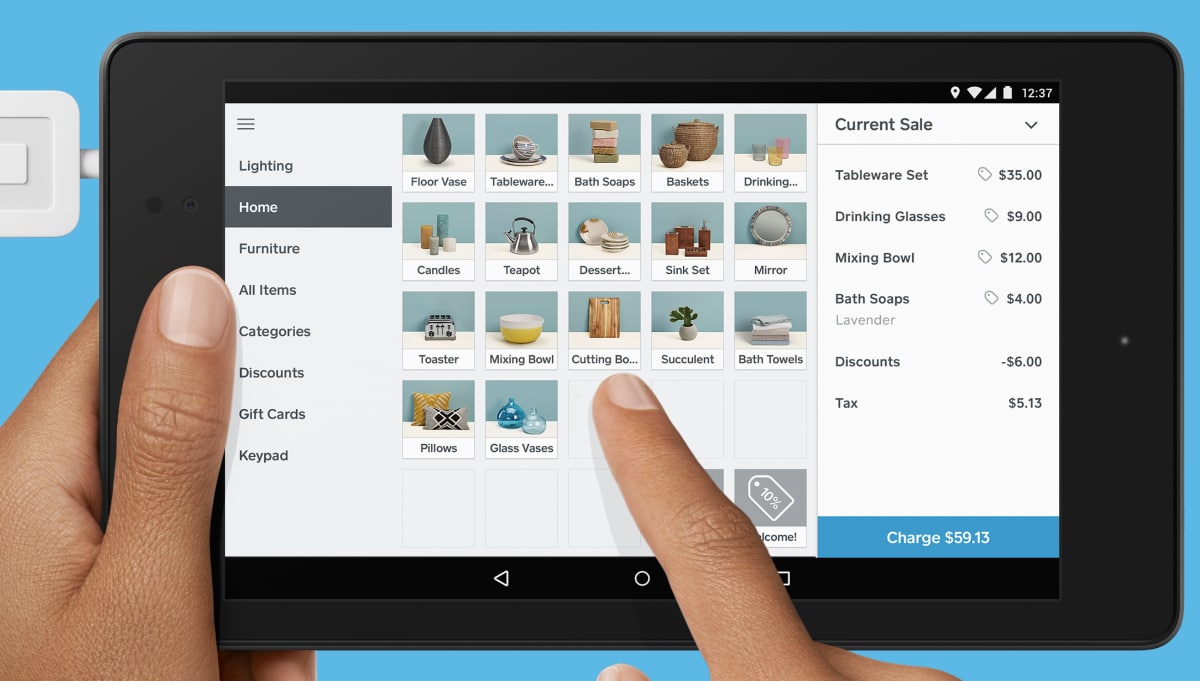

In this section, we will highlight the top card payment apps for Android, including their user ratings and popularity. We will cover widely used apps like PayPal, Google Pay, and Square, providing an overview of their features and functionalities.

2. Features to Look for in a Card Payment App

Choosing the right card payment app can be overwhelming, considering the multitude of options available. In this section, we will discuss the key features you should consider when selecting a card payment app for your Android device. From compatibility with various card readers to ease of use and integration with other business tools, we will help you understand what to look for.

3. Enhanced Security Measures in Card Payment Apps

Security is of utmost importance when it comes to digital transactions. In this section, we will focus on the security measures employed by card payment apps for Android. We will discuss encryption, tokenization, and other security features that ensure your financial data is protected from potential threats.

4. How Card Payment Apps Streamline Business Transactions

For business owners, card payment apps offer a range of advantages. In this section, we will explore how these apps streamline business transactions, from accepting payments to generating invoices and managing inventory. We will also discuss the integration of card payment apps with other business tools, such as accounting software and customer relationship management systems.

5. Contactless Payments and NFC Technology

In recent times, contactless payments have gained significant traction. This section will focus on the emergence of contactless payment technology and its integration with card payment apps for Android. We will explain how Near Field Communication (NFC) technology works and its benefits for both businesses and consumers.

6. The Future of Card Payment Apps

As technology continues to advance, card payment apps are expected to evolve as well. In this section, we will discuss the future trends and innovations in the field of card payment apps for Android. From biometric authentication to blockchain integration, we will provide insights into what the future holds for these apps.

7. Popular Card Payment Apps for Small Businesses

Small businesses have unique requirements when it comes to card payment apps. In this section, we will focus on the best card payment apps specifically designed for small businesses. We will consider factors such as affordability, scalability, and the ability to accept various payment methods.

8. Card Payment Apps for Personal Use

If you are an individual looking for a card payment app to simplify your personal transactions, this section is for you. We will discuss the top card payment apps that cater to personal users, highlighting their user-friendly interfaces, peer-to-peer payment capabilities, and budgeting features.

9. Comparing Transaction Fees and Processing Times

Transaction fees and processing times can vary significantly among different card payment apps. In this section, we will compare the fees charged by various apps and their corresponding processing times. This information will help you choose an app that aligns with your budget and time requirements.

10. Customer Support and User Satisfaction

Customer support is crucial when it comes to using card payment apps effectively. In this final section, we will discuss the customer support options offered by different apps and consider user satisfaction ratings. This will help you assess the level of assistance you can expect when using a particular card payment app for Android.

Choosing the right card payment app for your Android device can significantly enhance your financial transactions, whether you are a business owner or an individual user. In this comprehensive guide, we have explored the top-rated card payment apps, their features, and the security measures they employ to protect your financial data. We have also discussed how these apps streamline business transactions and cater to the needs of small businesses and personal users.

As technology continues to advance, the future of card payment apps looks promising, with innovations such as contactless payments, blockchain integration, and biometric authentication on the horizon. By considering factors like transaction fees, processing times, and customer support options, you can make an informed decision and choose the card payment app that best suits your requirements. Embrace the convenience and security of card payment apps for Android, and revolutionize the way you make transactions.