The Convenience of Credit Card Payment Android Apps

In today's digital age, the way we handle financial transactions has significantly evolved. With the rise of smartphones and mobile apps, managing our finances has become more convenient than ever. One such advancement is the credit card payment Android app, which allows users to make secure and hassle-free payments directly from their mobile devices.

Whether you're a business owner looking for an efficient payment solution or an individual who wants to simplify your financial transactions, a credit card payment Android app can be a game-changer. Let's explore the benefits and features of these apps and how they can enhance your payment experience.

Convenience at Your Fingertips

Gone are the days of carrying around bulky wallets filled with numerous credit cards. With a credit card payment Android app, all your payment information is stored securely in one place – your smartphone. This means you can make payments anytime, anywhere, without the need for physical cards or cash.

1. No More Carrying Multiple Cards

Having multiple credit cards can be cumbersome, especially when you need to make payments on the go. With a credit card payment Android app, you can store all your card information in one place. This eliminates the need to carry multiple physical cards, reducing the risk of loss or theft.

2. Quick and Easy Access

Imagine being able to make a payment with just a few taps on your smartphone. With a credit card payment Android app, this becomes a reality. You no longer have to fumble through your wallet or purse to find the right card. Simply open the app, select the desired card, and complete your transaction effortlessly.

3. Payment Anytime, Anywhere

Whether you're at a physical store, shopping online, or splitting a bill with friends at a restaurant, a credit card payment Android app allows you to make payments on the spot. As long as you have your smartphone with you, you have the power to make secure transactions wherever you are.

Enhanced Security Measures

One of the biggest concerns when it comes to financial transactions is security. Credit card payment Android apps prioritize user safety by implementing robust security measures. These apps often use encryption and tokenization techniques to protect your sensitive information, reducing the risk of fraud and unauthorized access.

1. Encryption for Data Protection

When you make a payment using a credit card payment Android app, your data is encrypted before it is transmitted. Encryption ensures that your personal and financial information is securely encoded, making it extremely difficult for hackers to intercept and decipher.

2. Tokenization for Secure Transactions

Credit card payment Android apps also utilize tokenization to enhance security during transactions. When you make a payment, a unique token is generated to represent your card details instead of transmitting your actual card number. This adds an extra layer of security, as the token cannot be used to make fraudulent transactions.

3. Biometric Authentication

Many credit card payment Android apps support biometric authentication, such as fingerprint or facial recognition. This feature adds an additional level of security by ensuring that only authorized users can access and make payments using the app. Biometric data is unique to each individual, making it difficult for others to replicate or use your credentials.

Streamlined Payment Process

With a credit card payment Android app, making payments becomes a breeze. No more fumbling through wallets or entering card details manually. Simply open the app, select the desired card, and complete the transaction with just a few taps. This streamlined process saves time and minimizes errors.

1. Quick and Efficient Payments

Traditional payment methods may require you to swipe or insert your credit card, enter a PIN, and sign a receipt. With a credit card payment Android app, the process is simplified. Just a few taps on your smartphone screen and the payment is done. This not only saves time but also eliminates the need for physical interaction with payment terminals.

2. Auto-Fill for Convenience

Entering card details manually can be time-consuming and prone to errors. Credit card payment Android apps often offer auto-fill features, which automatically populate the necessary fields with your card information. This eliminates the need to type out your card number, expiry date, and CVV code every time you make a payment.

3. Stored Payment Preferences

If you frequently make payments to the same merchants, a credit card payment Android app allows you to store your payment preferences. This means you can set up default cards for specific vendors, making future transactions with them even quicker. You can also save billing and shipping addresses, further streamlining the checkout process.

Multiple Card Management

If you're someone who owns multiple credit cards, managing them can be a hassle. A credit card payment Android app allows you to store and manage all your cards in one place. You can easily switch between cards when making payments and keep track of your transactions effortlessly.

1. Centralized Card Storage

Instead of rummaging through your physical wallet to find the right card, a credit card payment Android app provides a centralized storage solution. You can add all your credit cards to the app, including those from different banks or financial institutions. This way, you have easy access to your entire card collection wherever you go.

2. Card Switching Made Easy

When making a payment, you might want to use a specific card based on factors like rewards, cashback offers, or available credit limit. With a credit card payment Android app, switching between cards is a breeze. You can select the card you want to use for each transaction, providing you with flexibility and control over your payments.

3. Transaction History and Statements

Keeping track of your credit card transactions can be challenging, especially if you have multiple cards. Credit card payment Android apps offer transaction history and statements, allowing you to view and monitor your spending conveniently. You can review each transaction, categorize them, and even export the data for budgeting or expense tracking purposes.

Real-Time Transaction Notifications

Keeping track of your expenses is crucial for maintaining a healthy financial life. Credit card payment Android apps provide real-time notifications for every transaction, helping you stay on top of your spending. You can receive alerts for every payment made, ensuring transparency and awareness of your financial activities.

1. Instant Payment Notifications

As soon as a payment is made using a credit card payment Android app, you receive an instant notification on your smartphone. This allows you to stay updated on your spending habits and know when a transaction has been successfully processed. Instant notifications provide peace of mind and help prevent any unauthorized or fraudulent activities.

2. Customizable Alert Settings

Each credit card payment Android app offers different customization options for notifications. You can choose which types of transactions you want to be notified about, such as online purchases, in-store transactions, or recurring payments. By tailoring the alert settings to your preferences, you can better manage and track your expenses.

3. Transaction Verification

If you receive a notification for a transaction that you didn't authorize or recognize, credit card payment Android apps allow you to take immediate action. You can contact your card issuer or the app's support team to verify the transaction and address any potential issues. This level of transparency and control ensures the security of your financial transactions.

Integration with Loyalty Programs

Many credit card payment Android apps offer integration with loyalty programs, allowing you to earn rewards and discounts while making payments. This means you can enjoy additional benefits and savings, making your transactions even more rewarding.

1. Seamless Loyalty Rewards Redemption

By linking your credit card payment Android app with loyalty programs, you can seamlessly redeem rewards at the point of purchase. When making a payment, the app automatically detects eligible loyalty rewards and prompts you to apply them. This eliminates the need for separate loyalty cards or manual redemption processes.

2. Exclusive Discounts and Offers

Credit card payment Android apps may provide access to exclusive discounts and offers from partner merchants. By using the app for your payments, you can unlock special deals and enjoy savings on various products and services. This adds value to your transactions and enhances your overall shopping experience.

3. Consolidated Rewards Tracking

Keeping track of multiple loyalty programs can be a challenge, as each may have its own app or system. Credit card payment Android apps simplify this process by consolidating your rewards across different programs. You can view your accumulated points, track progress towards rewards, and even receive personalized recommendations based on your spending habits.

Accessibility for Small Businesses

For small business owners, accepting credit card payments can be a challenge. However, credit card payment Android apps provide an affordable and accessible solution. With these apps, businesses can easily accept payments from customers using their smartphones, eliminating the need for expensive card terminals.

1. Cost-Effective Payment Solution

Traditional card terminals often come with high setup costs, monthly fees, and transaction charges. Credit card payment Android apps offer a more cost-effective alternative for small businesses. The apps are usually free to download, and transaction fees are typically lower compared to traditional card terminals.

2. Mobility and Flexibility

With a credit card payment Android app, small businesses can accept payments anywhere, whether it's at a trade show, a pop-up store, or even at customers' homes. The mobility and flexibility provided by these apps enable businesses to adapt to different environments and cater to their customers' needs effectively.

3. Integration with Accounting Software

Credit card payment Android apps often integrate with popular accounting software, making it easier for small businesses to manage their finances. These integrations allow for seamless synchronization of transaction data, eliminating the need for manual data entry. This saves time and reduces the chances of errors in financial records.

Seamless Online Shopping Experience

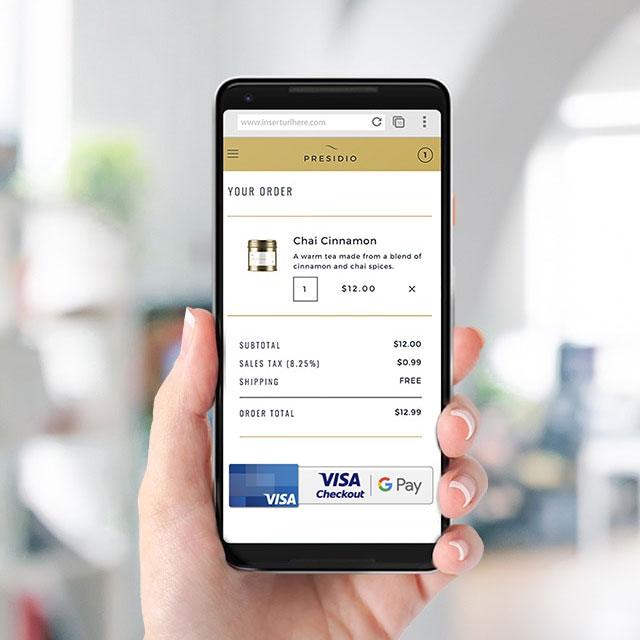

Online shopping has become increasingly popular, and credit card payment Android apps make the experience even more seamless. These apps often integrate with popular online shopping platforms, allowing you to make payments directly from the app without the hassle of entering card details manually.

1. One-Click Checkout

Entering your card details every time you shop online can be tedious and time-consuming. Credit card payment Android apps offer one-click checkout options for supported online merchants. This means you can complete your purchase with just a single tap, making the online shopping experience faster and more convenient.

2. Enhanced Security for Online Payments

When making online payments, security is paramount. Credit card payment Android apps provide an added layer of security by encrypting your card details and using tokenization techniques. This ensures that your sensitive information is protected, reducing the risk of data breaches or identity theft.

3. Simplified Returns and Refunds

In the event that you need to return or refund a product purchased online, credit card payment Android apps can simplify the process. Many apps allow you to initiate returns or dispute transactions directly from the app, saving you time and effort. This streamlines the overall shopping experience and provides peace of mind.

Splitting Bills Made Easy

Splitting bills among friends or colleagues can sometimes be a headache. However, credit card payment Android apps offer features that make splitting bills effortless. You can split the total amount, calculate individual shares, and request payments from others, simplifying the process and avoiding any awkwardness.

1. Bill Splitting Options

Credit card payment Android apps provide various bill splitting options to accommodate different scenarios. You can split the total amount equally among all parties, divide it based on specific percentages, or allocate individual items to different individuals. This flexibility ensures a fair and accurate distribution of expenses.

2. Seamless Request for Payments

Instead of manually collecting cash or waiting for friends to transfer money, credit card payment Android apps allow you to request payments directly from the app. You can send payment requests to specific contacts or create a shared payment link that can be shared via messaging apps or email. This simplifies the process and encourages prompt settlement of bills.

3. Transaction History for Accountability

When splitting bills, it's important to keep track of who paid for what. Credit card payment Android apps maintain a detailed transaction history, allowing you to reference and reconcile expenses easily. This helps ensure accountability and transparency among the parties involved, reducing the chances of misunderstandings or disputes.

Financial Insights and Analytics

Understanding your spending patterns and financial habits is essential for effective financial management. Credit card payment Android apps often provide detailed insights and analytics, allowing you to track your expenses, categorize transactions, and set budgeting goals.

1. Categorized Spending Analysis

Credit card payment Android apps automatically categorize your transactions based on spending patterns. You can view comprehensive reports and visualizations that break down your expenses into categories such as groceries, dining out, travel, and more. This gives you a clear overview of where your money is going and helps identify areas where you can save.

2. Budgeting and Expense Tracking

Keeping track of your expenses is crucial for staying within your budget. Credit card payment Android apps allow you to set spending limits for different categories and receive alerts when you approach or exceed those limits. You can also track your progress towards savings goals and monitor your financial health over time.

3. Personalized Recommendations

Based on your spending patterns and financial goals, credit card payment Android apps may provide personalized recommendations to help you make more informed financial decisions. These recommendations can range from suggestions for credit card offers that align with your preferences to tips for optimizing your rewards and savings.

The Future of Payment Solutions

Credit card payment Android apps are continuously evolving to meet the demands of users. As technology advances, we can expect even more innovative features and enhanced security measures. With the convenience and benefits they offer, these apps are undoubtedly shaping the future of payment solutions.

So, if you're looking for a convenient and secure way to make credit card payments, consider downloading a credit card payment Android app. Experience the ease and efficiency of managing your finances directly from your smartphone.

Invest in the future of payments, and embrace the power of credit card payment Android apps today!