Sofi Android App: Your All-in-One Personal Finance Solution

Managing your personal finances has never been easier with the Sofi Android app. Whether you're looking to budget, invest, save, or borrow money, this all-in-one app has got you covered. With its intuitive interface, powerful features, and top-notch security, Sofi is revolutionizing the way we handle our money. In this article, we will explore the key features of the Sofi Android app and how it can help you achieve your financial goals.

Seamless Budgeting

Effective budgeting is the foundation of financial success. With the Sofi Android app, you can say goodbye to spreadsheets and complicated budgeting apps. Sofi simplifies the budgeting process by allowing you to categorize your expenses, set spending limits, and track your progress effortlessly.

1. Categorize Your Expenses

When it comes to budgeting, understanding where your money goes is crucial. Sofi makes it easy by allowing you to categorize your expenses. You can create custom categories or choose from pre-defined ones such as groceries, utilities, entertainment, and more. By categorizing your expenses accurately, you can gain insights into your spending patterns and identify areas where you can cut back.

2. Set Spending Limits

Sticking to a budget requires discipline, but it can be challenging without clear spending limits. Sofi enables you to set spending limits for each category, ensuring that you stay on track. As you make purchases or payments, the app automatically deducts the amount from the corresponding category. This real-time tracking helps you avoid overspending and stay accountable to your financial goals.

3. Track Your Progress

Visualizing your budgeting progress is essential for staying motivated. Sofi provides clear visualizations that allow you to track your spending, savings, and overall budget progress. You can view graphs and charts that show how much you've spent in each category, how close you are to reaching your savings goals, and more. This visual feedback helps you make informed decisions and adjust your budget as needed.

4. Analyze Your Spending Patterns

Understanding your spending patterns is key to improving your financial habits. Sofi's budgeting feature goes beyond basic categorization and provides detailed insights into your spending habits. You can view reports that show your monthly, quarterly, or yearly spending trends. This analysis helps you identify areas where you might be overspending, allowing you to make necessary adjustments and save more effectively.

Intelligent Saving

Saving money is a crucial aspect of personal finance, but it can be challenging without the right tools and strategies. Sofi offers various saving options tailored to your needs and goals, making saving effortless and rewarding.

1. Automated Savings Plans

Sofi's automated savings plans take the effort out of saving. You can set up recurring transfers from your checking account to your Sofi savings account, ensuring that you save consistently. You can choose the frequency and amount of the transfers, allowing you to customize the plan according to your financial situation. This automated approach helps you build your savings effortlessly over time.

2. Round Up Purchases

Every time you make a purchase with your linked debit or credit card, Sofi can round up the transaction to the nearest dollar and transfer the spare change to your savings account. For example, if you buy a coffee for $2.50, Sofi will round it up to $3.00 and save the additional $0.50. This spare change can accumulate quickly and help you grow your savings without even realizing it.

3. Cashback Rewards

Who doesn't love earning rewards while saving? Sofi offers cashback rewards on eligible purchases made with your Sofi Money debit card. These rewards can be directly deposited into your Sofi savings account, allowing you to boost your savings effortlessly. This feature allows you to save while enjoying the benefits of your everyday spending.

4. Goal-Based Saving

Whether you're saving for a vacation, a down payment on a house, or an emergency fund, Sofi's goal-based saving feature can help you reach your financial milestones. You can set specific savings goals within the app and track your progress towards them. Sofi provides insights into how much you need to save each month to achieve your goals within your desired timeframe. This personalized approach keeps you motivated and focused on your savings journey.

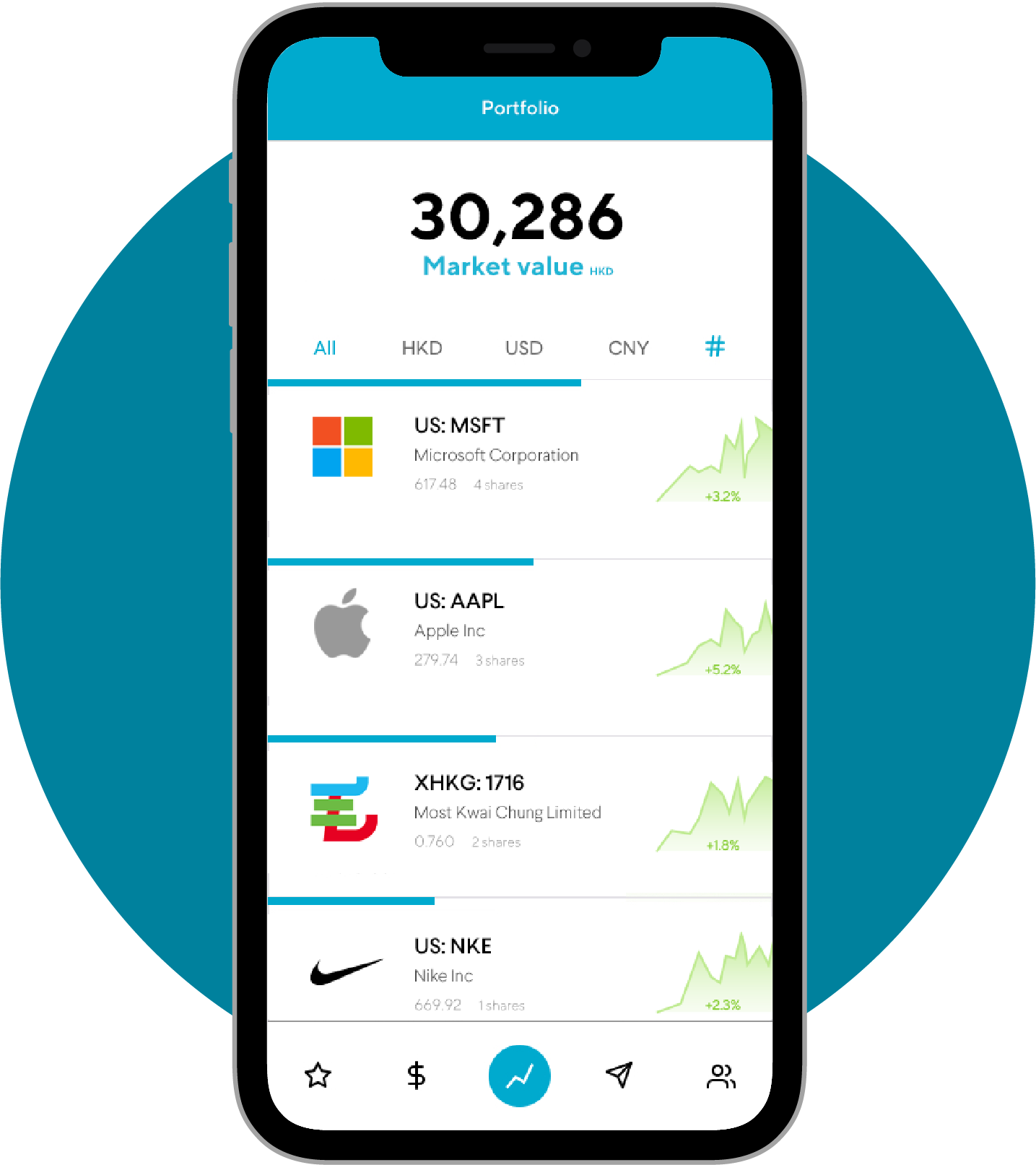

Investment Opportunities

Investing is an essential part of building wealth and securing your financial future. However, it can be intimidating, especially for beginners. The Sofi Android app aims to make investing accessible to everyone, providing the tools and resources needed to make informed investment decisions.

1. User-Friendly Interface

Sofi's investment feature is designed with simplicity in mind. The app's user-friendly interface guides you through the investment process step by step, ensuring that you feel confident and comfortable with your investment choices. Whether you're a seasoned investor or a beginner, navigating the app is a breeze.

2. Educational Resources

Investing can be complex, but Sofi believes in empowering its users through financial education. The app provides a wealth of educational resources, including articles, videos, and webinars, to help you improve your financial literacy. You can learn about different investment strategies, risk management, diversification, and more. This knowledge equips you with the confidence to make informed investment decisions.

3. Personalized Investment Portfolios

Not sure where to start with investing? Sofi has got you covered. The app allows you to create a personalized investment portfolio based on your risk tolerance and financial goals. You can answer a series of questions to determine your investment preferences, and Sofi will recommend a diversified portfolio tailored to your needs. This personalized approach takes the guesswork out of investing and helps you build a well-balanced portfolio.

4. Real-Time Market Data and Insights

Keeping up with market trends and staying informed is crucial when it comes to investing. Sofi provides real-time market data and insights to help you make informed investment decisions. You can access stock quotes, track your portfolio's performance, and receive market news and updates directly within the app. This real-time information empowers you to seize investment opportunities and make adjustments when needed.

Borrowing Made Simple

There are times when borrowing becomes a necessity, whether it's for a personal loan, a mortgage, or student loan refinancing. Sofi understands these needs and simplifies the borrowing process, offering competitive interest rates and a streamlined application process.

1. Transparent Loan Options

Sofi provides transparent information about its loan options, allowing you to compare and choose the best fit for your needs. Whether you're looking for a personal loan to consolidate debt or a mortgage to buy a new home, Sofi offers a range of loan options with competitive interest rates and flexible terms. You can easily explore the details of each loan option within the app.

2. Streamlined Application Process

Applying for a loan can be time-consuming and stressful, but Sofi streamlines the process to make it as smooth as possible. The app guides you through the loan application step by step, ensuring that you provide all the necessary information. You can upload required documents directly within the app, eliminating the need for lengthy paperwork. Once you've submitted your application, you can track its progress and receive updates in real-time.

3. Loan Eligibility Checker

Wondering if you're eligible for a loan? Sofi's loan eligibility checker helps you find out without affecting your credit score. You can enter some basic information, such as your income, employment status, and desired loan amount, and Sofi will provide you with an idea of your eligibility and potential interest rates. This feature allows you to explore your borrowing options without committing to a full application.

4. Transparent Loan Terms and Rates

Sofi believes in transparency when it comes to borrowing. The app clearly presents the terms and rates associated with each loan option, ensuring that you fully understand the costs and conditions before proceeding. This transparency helps you make an informed decision and choose the loan option that aligns with your financial goals.

Strong Security Measures

When it comes to personal finance, security is of utmost importance. Sofi understands this and prioritizes the security of your financial information. The app implements robust security measures to protect your sensitive data from unauthorized access.

1. Data Encryption

Sofi encrypts your data using industry-standard encryption protocols. This ensures that your personal and financial information remains secure during transmission and storage. Data encryption protects your information from being intercepted or accessed by unauthorized individuals, giving you peace of mind while using the app.

2. Two-Factor Authentication

Sofi adds an extra layer of security with its two-factor authentication feature. When you log in to the app from a new device or browser, you will be prompted to enter a verification code sent to your registered email or phone number. This additional step ensures that only authorized individuals can access your account, reducing the risk of unauthorized access.

3. Biometric Login Options

For added convenience and security, Sofi offers biometric login options, such as fingerprint or facial recognition. These biometric authentication methods provide a secure and convenient way to access your account, eliminating the need to remember complex passwords. Biometric login adds an extra layer of protection against unauthorized access.

4. Account Activity Monitoring

Sofi continuously monitors your account activity to detect any suspicious or unauthorized transactions. If any unusual activity is detected, you will be notified immediately through the app or email. This proactive monitoring helps identify and prevent fraudulent activities, ensuring the security of your financial information.

Financial Education and Community

Financial education is essential for making informed financial decisions and achieving long-term financial success. Sofi believes in empowering its users through educational resources and a vibrant community.

1. Educational Resources

Sofi provides a wealth of educational resources to help you improve your financial literacy. Within the app, you can access articles, videos, and webinars on various topics, including budgeting, saving, investing, and borrowing. These resources are designed to simplify complex financial concepts and provide practical tips for managing your money effectively. By enhancing your financial knowledge, you can make more informed decisions and take control of your financial future.

2. Community Support

Sofi has a vibrant community where you can connect with like-minded individuals, ask questions, and share experiences. The community allows you to learn from others, seek advice, and gain insights into different financial journeys. Whether you're looking for motivation, support, or simply a place to discuss financial topics, the Sofi community provides a supportive environment to connect with others on a similar financial path.

3. Financial Planning Services

In addition to educational resources and community support, Sofi offers financial planning services to help you navigate complex financial situations. Whether you need guidance on retirement planning, investment strategies, or debt management, Sofi's certified financial planners can provide personalized advice tailored to your unique circumstances. This personalized support ensures that you receive expert guidance on your financial journey.

4. Career Support

Sofi understands that financial success is closely tied to professional growth and career development. The app offers career support services, including resume reviews, interview coaching, and salary negotiation tips. These resources can help you advance in your career and increase your earning potential, ultimately contributing to your overall financial well-being.

Conclusion

The Sofi Android app is a game-changer for anyone looking to take control of their personal finances. With its seamless budgeting, intelligent saving, investment opportunities, simplified borrowing, robust security measures, commitment to financial education, and vibrant community, Sofi offers a comprehensive solution to all your financial needs. Download the Sofi Android app today and embark on your journey towards financial freedom.