Penny Stock App for Android: A Comprehensive Guide to Mastering the Stock Market

Are you an aspiring investor looking to make a fortune in the stock market? Look no further than the penny stock app for Android. In this comprehensive guide, we will take you through everything you need to know about penny stocks and how this app can help you navigate the unpredictable world of trading.

Before we dive into the details, let's first understand what penny stocks are and why they present an intriguing investment opportunity for many.

What are Penny Stocks?

Penny stocks are low-priced stocks that trade outside of the major stock exchanges. They typically have a share price of less than $5 and are often associated with small-cap companies with limited market capitalization. These stocks are considered to be highly speculative and can be subject to extreme price fluctuations.

One of the main reasons investors are drawn to penny stocks is the potential for significant gains in a short period. Due to their low share prices, even a small increase in value can result in substantial returns. However, it's important to note that penny stocks also carry a higher level of risk compared to more established stocks on major exchanges.

The Risks of Penny Stock Trading

While penny stocks can offer lucrative opportunities, they also come with inherent risks. It's crucial to understand these risks before diving into the world of penny stock trading.

1. Lack of liquidity: Penny stocks often have lower trading volumes, which means it may be challenging to buy or sell shares at the desired price, especially during volatile market conditions.

2. Limited information: Small-cap companies may not be required to disclose as much information as larger, publicly traded companies. This lack of transparency can make it difficult to evaluate the company's financial health and potential for growth.

3. Market manipulation: The penny stock market is notorious for pump-and-dump schemes, where scammers artificially inflate the stock price through false information and then sell their shares, leaving unsuspecting investors with significant losses.

4. Volatility: Penny stocks are known for their price volatility, which can result in rapid and significant price swings. This volatility can be both an opportunity for profit and a risk for loss.

Despite these risks, many investors are drawn to penny stocks due to their potential for high returns. This is where a penny stock app for Android can be a valuable tool in your trading arsenal.

Benefits of Using a Penny Stock App

With the advancement of technology, trading no longer requires a physical presence on the trading floor. A penny stock app for Android can offer several benefits to traders, making it easier and more convenient to navigate the world of penny stocks.

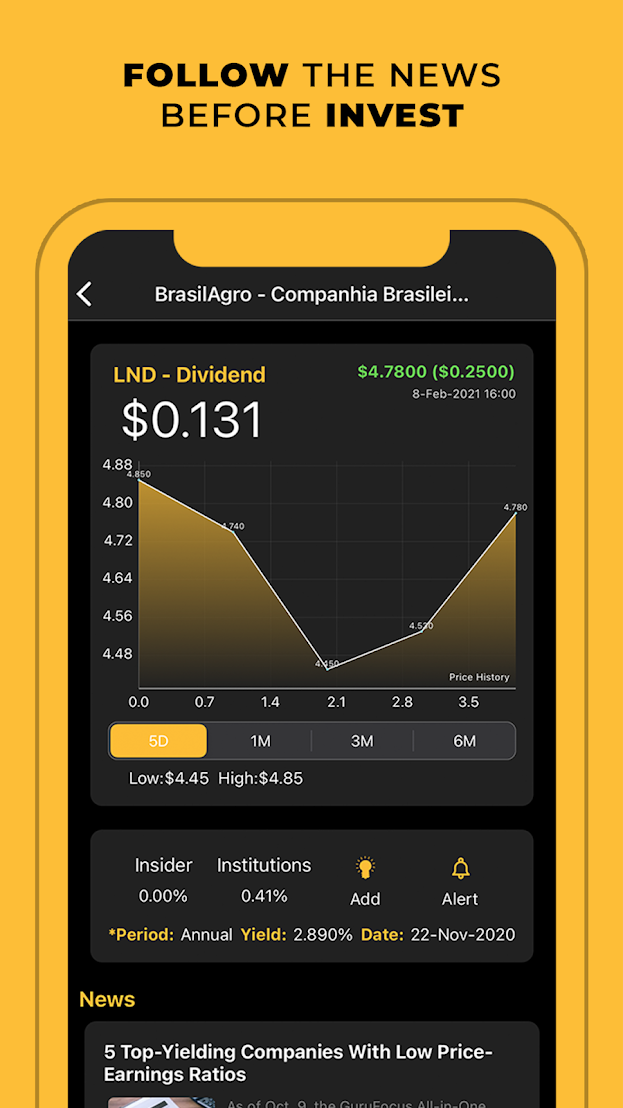

Real-Time Stock Quotes and Market News

A penny stock app provides real-time stock quotes, allowing you to stay updated on the latest market prices and trends. This real-time information is crucial for making informed investment decisions and taking advantage of timely opportunities.

Additionally, the app provides access to market news and updates, ensuring you stay informed about the latest developments that may impact your chosen penny stocks. This information can help you identify potential catalysts for price movements and adjust your trading strategy accordingly.

Customizable Watchlists

A penny stock app allows you to create personalized watchlists, which are lists of stocks you are interested in monitoring. This feature enables you to track the performance of specific penny stocks, ensuring you don't miss out on any important developments.

By customizing your watchlist, you can focus on the stocks that align with your trading strategy and filter out the noise. This helps you stay organized and ensures you have a clear overview of the stocks that deserve your attention.

Technical Analysis Tools

Technical analysis is a popular approach to trading, where traders analyze historical price patterns and indicators to make predictions about future price movements. A penny stock app often comes equipped with various technical analysis tools, making it easier for you to conduct in-depth analysis without relying on external platforms.

These tools may include charting features, trend lines, moving averages, and oscillators, among others. By utilizing these technical analysis tools within the app, you can identify potential entry and exit points for your trades, enhancing your decision-making process.

Price Alerts and Notifications

Staying on top of the market can be a challenge, especially if you have other commitments or a busy schedule. A penny stock app can help by providing price alerts and notifications.

You can set up alerts for specific price levels or percentage changes in the stocks you are monitoring. When the price reaches your specified criteria, the app will notify you, allowing you to take immediate action if needed.

Mobile Trading on the Go

One of the most significant advantages of a penny stock app for Android is the ability to trade on the go. You can access your trading account and execute trades from anywhere with an internet connection, giving you flexibility and convenience.

Whether you're commuting, traveling, or simply away from your computer, having a mobile trading platform ensures you never miss out on potential trading opportunities. This real-time accessibility can be a game-changer, particularly in fast-moving markets.

Choosing the Right Penny Stock App

Now that you understand the benefits of using a penny stock app, it's crucial to choose the right one for your trading needs. Here are some factors to consider when selecting a penny stock app for your Android device:

User-Friendly Interface

The app should have an intuitive and user-friendly interface that allows you to navigate seamlessly and access the features you need. Look for an app that offers a clean design and easy-to-use menus, ensuring you can focus on trading rather than struggling with a complicated interface.

Real-Time Data and Analysis

Accurate and up-to-date data is crucial when trading penny stocks. Ensure the app provides real-time stock quotes, market news, and charts that are continuously updated. Having access to reliable data enables you to make informed trading decisions based on the most current information available.

Technical Analysis Tools and Indicators

If you rely on technical analysis in your trading strategy, ensure the app offers a comprehensive set of tools and indicators. Look for features such as customizable charts, drawing tools, and popular indicators like moving averages, MACD, and RSI.

Watchlist and Portfolio Management

Check if the app allows you to create and manage watchlists and portfolios. This feature is particularly important if you trade multiple stocks or want to track specific penny stocks closely. A robust watchlist and portfolio management system can help you stay organized and monitor your positions effectively.

Order Types and Trading Options

Consider the types of orders and trading options available within the app. Look for features like market orders, limit orders, and stop-loss orders. Additionally, check if the app supports extended hours trading if you want to take advantage of pre-market or after-hours trading opportunities.

Customer Support

In case you encounter any issues or have questions, reliable customer support is essential. Look for an app that offers responsive customer support channels, such as live chat, email, or phone support. Having prompt assistance can save you time and frustration in case you need technical or account-related help.

Take your time to research and compare different penny stock apps before making a final decision. Pay attention to user reviews and ratings to get a sense of the app's reliability and performance. Choosing the right app can greatly enhance your trading experience and increase your chances of success.

Getting Started with the Penny Stock App

Now that you have chosen the right penny stock app for your Android device, it's time to get started. Here is a step-by-step guide on how to download, install, and set up the app:

Step 1: Download the App

Visit the Google Play Store on your Android device and search for the penny stock app you have chosen. Once you find it, click on the "Install" button to download the app onto your device.

Step 2: Create an Account

Launch the app and follow the on-screen instructions to create a new account. You will likely be required to provide personal information, such as your name, email address, and possibly a phone number. Ensure you choose a strong password to protect your account.

Step 3: Fund Your Account

Once your account is created, you will need to fund it to start trading. The app will guide you through the process, which may involve linking a bank account or transferring funds from another brokerage account. Follow the instructions provided and ensure you understand any fees or charges associated with funding your account.

Step 4: Explore the App's Features

Once your account is funded, take some time to explore the various features and functionalities of the app. Familiarize yourself with the layout, navigation, and available tools. This will help you make the most of the app's capabilities and optimize your trading experience.

Step 5: Customize Your Settings

Most penny stock apps allow you to customize settings and preferences according to your trading style and preferences. Take advantage of these options to tailor the app to your specific needs. This may include setting up price alerts,

Step 5: Customize Your Settings

Most penny stock apps allow you to customize settings and preferences according to your trading style and preferences. Take advantage of these options to tailor the app to your specific needs. This may include setting up price alerts, choosing your preferred charting style, adjusting notification settings, and more. By customizing the app, you can ensure it aligns with your trading strategy and provides the information you need most.

Step 6: Familiarize Yourself with the Trading Interface

Before placing any trades, spend some time getting familiar with the trading interface. Review the order entry screens, understand the different order types available, and practice placing trades with virtual or demo accounts if offered by the app. Becoming comfortable with the trading interface will help you execute trades efficiently and avoid costly mistakes.

Step 7: Stay Updated and Educated

Trading in the penny stock market requires continuous learning and staying updated on market trends. Make use of the app's educational resources, such as tutorials, webinars, or articles, to enhance your knowledge and understanding of penny stocks. Additionally, stay connected to market news and developments by regularly checking the app's news feed or subscribing to relevant newsletters or alerts.

Researching Penny Stocks

Research is a fundamental aspect of successful penny stock trading. A penny stock app provides various tools and resources to help you conduct thorough research and identify potential penny stock investments. Here are some strategies and resources to consider:

Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health, management team, competitive position, and growth potential. Utilize the app's fundamental analysis tools, such as financial statements, earnings reports, and company profiles, to assess the viability of penny stocks. Look for indicators such as revenue growth, profitability, debt levels, and industry trends to make informed investment decisions.

Technical Analysis

Technical analysis focuses on analyzing historical price patterns, chart patterns, and indicators to predict future price movements. Take advantage of the app's technical analysis tools, such as customizable charts, indicators, and drawing tools, to identify patterns and trends in penny stocks. Look for signals such as support and resistance levels, moving averages crossovers, and chart patterns like triangles or head and shoulders formations.

Social Media and Online Communities

Social media platforms and online communities can provide valuable insights and information about penny stocks. Join forums or groups dedicated to penny stock trading within the app or explore external platforms to connect with other traders and share knowledge. However, exercise caution and verify the credibility of the information shared, as the penny stock market is susceptible to rumors and misinformation.

News and Market Updates

Stay informed about the latest news and market updates that may impact penny stocks. The app's news feed or market analysis section can provide real-time updates on earnings releases, regulatory changes, industry news, and other factors that may influence the performance of penny stocks. By staying updated, you can adjust your trading strategy accordingly and capitalize on potential opportunities.

Penny Stock Screeners

A penny stock screener is a tool that allows you to filter and sort penny stocks based on specific criteria. Utilize the app's penny stock screener to narrow down your options and find penny stocks that meet your desired parameters. Common screening criteria include price range, market capitalization, trading volume, and fundamental indicators like earnings per share or price-to-earnings ratio.

Building a Penny Stock Watchlist

Creating and managing a personalized watchlist within the penny stock app is essential for tracking and monitoring your preferred penny stocks. Here's how you can effectively build and utilize your watchlist:

Identify Potential Penny Stocks

Based on your research and analysis, identify penny stocks that show potential for growth or align with your trading strategy. Look for stocks with positive fundamental indicators, promising technical patterns, or positive sentiment in the market. Add these stocks to your watchlist to closely monitor their performance.

Monitor Price Movements

Regularly track the price movements of the stocks in your watchlist. Utilize the app's real-time stock quotes and charting features to monitor changes in price, volume, and other relevant indicators. Pay attention to any significant price movements or patterns that may indicate entry or exit points for potential trades.

Set Price Alerts

To stay informed about price movements without constantly monitoring the app, set up price alerts for the stocks in your watchlist. Specify your desired price levels or percentage changes, and the app will notify you when those levels are reached. Price alerts can help you take timely action and seize trading opportunities even when you're not actively watching the market.

Track News and Catalysts

Keep an eye on news and catalysts that may impact the stocks in your watchlist. The app's news feed or market analysis section can provide updates on company announcements, industry developments, or economic news that may influence stock prices. Stay informed about any upcoming earnings releases, product launches, regulatory changes, or mergers and acquisitions that may affect your watchlist stocks.

Review and Update Regularly

Regularly review and update your watchlist based on changing market conditions or new information. Remove stocks that no longer meet your criteria or show poor performance, and add new stocks that exhibit potential. Maintaining an up-to-date watchlist ensures you focus on the most relevant penny stocks and make informed trading decisions.

Analyzing Penny Stock Charts

Chart analysis is a vital component of penny stock trading, as it helps you identify trends, patterns, and potential trading opportunities. Here's how to effectively analyze penny stock charts using the tools and indicators provided by the app:

Choose the Right Timeframe

Start by selecting an appropriate timeframe for your chart analysis. Short-term traders may prefer shorter timeframes like intraday or hourly charts, while long-term investors may focus on daily or weekly charts. Experiment with different timeframes to find the one that suits your trading style and objectives.

Identify Trend Lines

Trend lines are used to identify the direction of the stock's price movement. An uptrend is characterized by higher highs and higher lows, while a downtrend exhibits lower highs and lower lows. Draw trend lines on the chart to visualize the stock's trend and determine potential support and resistance levels.

Utilize Moving Averages

Moving averages are popular indicators used to smooth out the price data and identify trends. The app's charting features should provide options to overlay different moving averages on the chart. Common moving averages used in penny stock trading include the 50-day moving average and the 200-day moving average. Pay attention to crossovers between moving averages, as they can indicate potential buying or selling signals.

Spot Chart Patterns

Chart patterns are formations that occur on price charts and provide insights into potential future price movements. Common chart patterns include triangles, head and shoulders, double tops, and double bottoms. Learn to recognize these patterns on the app's charts and understand their implications. Chart patterns can help you identify potential entry or exit points for your trades.

Use Oscillators and Indicators

Oscillators and technical indicators are used to measure the momentum and strength of price movements. The app should offer a variety of popular indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator. These indicators can help confirm or refute potential trading signals derived from other chart analysis techniques.

Combine Multiple Analysis Techniques

Avoid relying on a single analysis technique or indicator. Instead, combine multiple analysis techniques to strengthen your trading decisions. For example, if a stock shows a bullish chart pattern, confirm it with bullish signals from oscillators or positive news catalysts. By using a combination of analysis techniques, you can increase the probability of accurate trade decisions.

Placing Trades and Managing Positions

Once you have identified a potential trade opportunity, it's time to place your trade and effectively manage your positions. Here's how you can do it using the penny stock app:

Select the Order Type

Choose the appropriate order type for your trade. Common order types include market orders, limit orders, and stop orders. A market order executes the trade at the current market price, while a limit order allows you to set a specific price at which you want the trade to be executed. A stop order is used to protect against potential losses by automatically triggering a sale if the price reaches a specified level.

Set the Order Parameters

Specify the quantity of shares you want to buy or sell and the price at which you want the trade to take place. Double-check your order parameters to ensure accuracy before submitting the order. Pay attention to any additional options provided by the app, such as extended hours trading or time-in-force options.

Review and Confirm

Before finalizing the trade, review all the order details, including the quantity, price, and order type. Ensure everything is correct and aligns with your trading strategy. Once you are confident, confirm the trade by clicking the appropriate button or following the instructions provided by the app.

Monitor Your Positions

Afterplacing a trade, it's essential to monitor your positions closely. The penny stock app allows you to track your open positions and stay updated on their performance. Here's how you can effectively manage your positions:

Set Stop-Loss Orders

To protect your investment from significant losses, consider setting stop-loss orders for your positions. A stop-loss order automatically triggers a sell order if the stock's price reaches a specified level. By setting a stop-loss order, you can limit your potential losses and manage risk effectively. Determine an appropriate stop-loss level based on your risk tolerance and the stock's volatility.

Adjust Stop-Loss Orders

As the price of a penny stock fluctuates, it's important to adjust your stop-loss orders accordingly. If the stock's price increases, you may want to raise your stop-loss level to lock in profits and protect your gains. Conversely, if the price decreases, you might consider lowering your stop-loss level to mitigate potential losses. Regularly review and adjust your stop-loss orders based on the stock's performance.

Take Profit at Target Levels

In addition to setting stop-loss orders, it's important to have profit targets for your positions. Determine a specific price level or percentage gain at which you want to exit the position and take profits. When the stock's price reaches your target, consider selling a portion or all of your shares to secure profits. Taking profits at target levels helps you capitalize on successful trades and avoid greed-driven decisions.

Monitor Market News and Developments

Stay updated on market news and developments that may impact your positions. The penny stock app's news feed or market analysis section can provide insights into earnings releases, regulatory changes, or industry news that may affect the stock's performance. By staying informed, you can make informed decisions about whether to hold, sell, or add to your positions based on the new information.

Review and Adjust Your Strategy

Regularly assess the performance of your positions and review your overall trading strategy. Evaluate whether your trades align with your initial analysis and objectives. If necessary, make adjustments to your strategy based on lessons learned or changing market conditions. Trading is a continuous learning process, and adapting your strategy is crucial for long-term success.

Risk Management Strategies

Managing risk is a key component of successful penny stock trading. Implementing effective risk management strategies can help protect your investment capital and minimize potential losses. Here are some risk management techniques to consider:

Diversification

One of the most fundamental risk management strategies is diversifying your portfolio. Instead of investing all your capital in a single penny stock, spread your investments across multiple stocks from different industries or sectors. Diversification helps reduce the impact of a single stock's poor performance on your overall portfolio. However, keep in mind that diversification does not guarantee profits or eliminate all risks.

Position Sizing

Position sizing refers to determining the appropriate amount of capital to allocate to each trade. Avoid risking a significant portion of your capital on a single trade, as it can lead to substantial losses. Instead, determine a position size that aligns with your risk tolerance and the specific trade's risk-reward ratio. Consider factors such as stop-loss levels, target prices, and overall portfolio risk when determining position sizes.

Set Realistic Profit Targets

It's essential to set realistic profit targets for your trades. Greed-driven decisions often lead to holding onto positions for too long, hoping for unrealistic gains. Analyze the stock's potential and set profit targets based on realistic expectations. Taking profits at target levels helps you lock in gains and avoid potential reversals or downturns in the stock's price.

Implement Stop-Loss Orders

Stop-loss orders are an effective risk management tool to limit potential losses. Set stop-loss orders at appropriate levels based on your analysis and risk tolerance. If the stock's price reaches your predetermined stop-loss level, the order is triggered, and your position is automatically sold. Stop-loss orders help protect your capital from significant losses in case the trade doesn't go as planned.

Continuous Learning and Adaptation

As the penny stock market evolves, it's crucial to continuously learn and adapt your trading approach. Stay updated on market trends, industry developments, and new trading strategies. Learn from your successes and failures and refine your risk management techniques accordingly. The ability to adapt to changing market conditions and adjust your strategy is vital for long-term success in penny stock trading.

Learning from Successful Penny Stock Traders

Learning from experienced and successful penny stock traders can provide valuable insights and lessons that can enhance your trading journey. Here are some ways to gain knowledge and inspiration from successful traders:

Read Books and Biographies

Many successful traders have shared their knowledge and experiences through books and biographies. Explore literature on penny stock trading, investment strategies, and the stories of successful traders. Learn from their triumphs and mistakes to gain a deeper understanding of the market and improve your own trading skills.

Follow Trading Blogs and Websites

Follow popular trading blogs and websites that provide educational content, market analysis, and interviews with successful traders. These platforms often share valuable insights, tips, and strategies that can help you refine your approach to penny stock trading. Engage with the trading community by participating in discussions or commenting on articles to learn from others and expand your network.

Attend Webinars and Online Courses

Webinars and online courses offer a structured learning environment for traders of all levels. Look for webinars or courses conducted by successful penny stock traders or industry experts. These learning opportunities can provide in-depth knowledge, practical techniques, and real-life examples that can enhance your understanding of penny stock trading.

Join Trading Communities and Forums

Engage with other penny stock traders by joining trading communities and forums. These platforms allow you to connect with like-minded individuals, share experiences, ask questions, and learn from one another. Participating in discussions, analyzing trade ideas, and receiving feedback from experienced traders can accelerate your learning curve and provide valuable insights.

Follow Successful Traders on Social Media

Many successful traders share their thoughts, trades, and insights on social media platforms. Follow reputable traders on platforms like Twitter, Instagram, or YouTube to gain valuable insights into their trading strategies and thought processes. However, exercise caution and conduct your own research before implementing any strategies or trades shared on social media.

Practice and Analyze Trades

Continuously practice trading and analyze your trades to identify areas for improvement. Keep a trading journal and document your trades, including the rationale behind each trade and the outcome. Review your journal regularly to identify patterns, mistakes, or successful strategies. By analyzing your trades, you can learn from your experiences and refine your trading approach over time.

In conclusion, the penny stock app for Android is a powerful tool that can help you navigate the complexities of the stock market. By understanding the fundamentals, utilizing the app's features, conducting thorough research, and implementing effective risk management strategies, you can increase your chances of success in the world of penny stock trading. So, download the app, educate yourself, and embark on your journey to financial freedom!