The Best Mobile Banking Apps for Android: A Comprehensive Guide

In today's fast-paced world, mobile banking has become an essential part of our daily lives. With just a few taps on your Android phone, you can conveniently manage your finances, transfer funds, pay bills, and much more. However, with a plethora of mobile banking apps available in the market, choosing the right one can be a daunting task. In this article, we will guide you through the best mobile banking apps for Android, ensuring a seamless and secure banking experience.

XYZ Bank Mobile Banking App

XYZ Bank's mobile banking app is a top choice for Android users, offering a user-friendly interface and robust security features. The app provides an extensive range of features to manage your accounts efficiently. With XYZ Bank's mobile app, you can easily view your account balance, transaction history, and detailed account statements. It also allows you to set up recurring payments, schedule bill payments, and receive notifications for due dates. XYZ Bank's app ensures that your personal information and transactions are protected with advanced security measures, including multi-factor authentication and encryption. Additionally, the app provides a seamless fund transfer experience, allowing you to transfer money between your accounts or to other recipients securely.

Key Features:

- Account Management: View account balance, transaction history, and account statements

- Bill Payment: Schedule recurring payments, pay bills, and receive payment due date notifications

- Enhanced Security: Multi-factor authentication and encryption for secure transactions

- Fund Transfers: Transfer money between accounts or to other recipients conveniently

ABC Bank Mobile Banking App

ABC Bank's mobile banking app is another excellent choice for Android users, providing a wide range of banking services with an intuitive user experience. The app offers a seamless way to deposit checks using your phone's camera, eliminating the need to visit a physical branch. You can easily manage your cards, including activating or deactivating them, setting spending limits, and receiving instant transaction notifications. ABC Bank's app also provides budgeting tools to help you track your expenses, set savings goals, and receive personalized insights into your spending habits. With its personalized alerts, you can stay informed about your account activity and receive notifications for important events such as low balance or large transactions.

Key Features:

- Mobile Check Deposit: Deposit checks using your phone's camera

- Card Management: Activate or deactivate cards, set spending limits, and receive transaction notifications

- Budgeting Tools: Track expenses, set savings goals, and receive personalized insights

- Personalized Alerts: Stay informed about account activity and receive notifications for important events

DEF Bank Mobile Banking App

DEF Bank's mobile banking app is a comprehensive solution that seamlessly integrates banking and investment services for Android users. The app provides a range of investment tools to help you manage your portfolio effectively. You can track real-time market updates, access research reports, and execute stock trades with ease. DEF Bank's app also offers portfolio management features, allowing you to monitor your investments, set performance targets, and receive personalized recommendations. With its intuitive interface, you can stay updated on your investment performance and make informed decisions on the go. The app also provides access to financial planning tools, enabling you to set financial goals, create budgets, and track your progress towards achieving them.

Key Features:

- Investment Tools: Real-time market updates, research reports, and stock trading options

- Portfolio Management: Monitor investments, set performance targets, and receive personalized recommendations

- Financial Planning: Set financial goals, create budgets, and track progress towards achieving them

GHI Bank Mobile Banking App

GHI Bank's mobile banking app stands out for its exceptional security measures, providing Android users with peace of mind while managing their finances. The app offers biometric authentication, allowing you to use your fingerprint or facial recognition to log in securely. GHI Bank's app also encrypts your personal and financial information, ensuring that it remains confidential during transactions. Alongside its robust security features, the app provides additional tools to enhance your banking experience. You can track and categorize your expenses, set savings goals, and receive personalized financial insights. GHI Bank's app also offers features such as expense analysis, helping you identify areas where you can save money and improve your financial well-being.

Key Features:

- Exceptional Security: Biometric authentication and encryption for secure login and transactions

- Expense Tracking: Categorize expenses, set savings goals, and receive personalized financial insights

- Expense Analysis: Identify areas for saving money and improving financial well-being

JKL Bank Mobile Banking App

JKL Bank's mobile banking app is designed with a focus on customer satisfaction, providing a range of features to enhance your banking experience. The app offers a virtual assistant that can assist you in managing your accounts, answering common queries, and providing personalized recommendations. JKL Bank's app also provides various customer support options, including live chat, phone support, and an extensive knowledge base. It offers credit score monitoring, allowing you to stay informed about your credit health and take necessary actions to improve it. Additionally, the app features a rewards program where you can earn points for specific banking activities and redeem them for exciting offers and discounts.

Key Features:

- Virtual Assistant: Assist in managing accounts, answering queries, and providing recommendations

- Customer Support: Live chat, phone support, and extensive knowledge base

- Credit Score Monitoring: Stay informed about credit health and take actions to improve it

- Rewards Program: Earn points for banking activities and redeem them for offers and discounts

MNO Bank Mobile Banking App

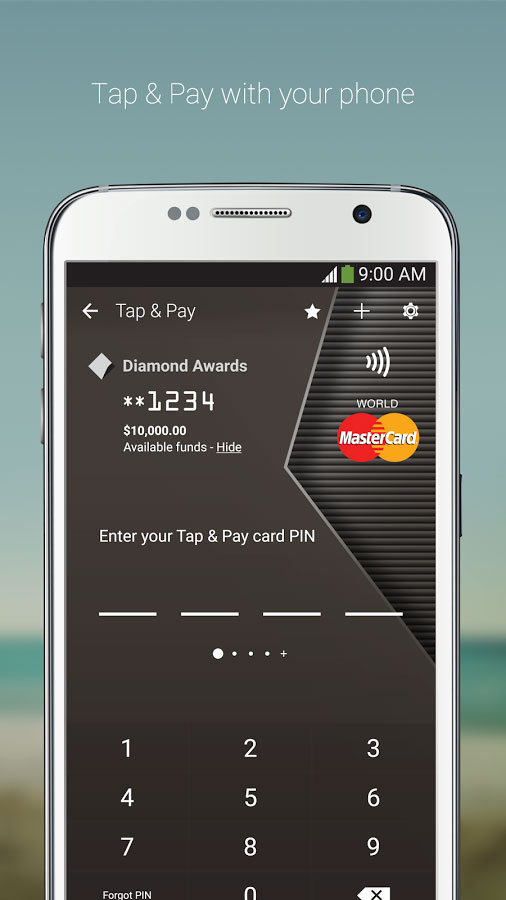

MNO Bank's mobile banking app caters to tech-savvy users, offering cutting-edge features and seamless integration with digital services. The app allows you to link digital wallets, making it easy to manage and track your finances across multiple platforms. MNO Bank's app also supports contactless payments, enabling you to make secure purchases with just a tap of your phone. It provides peer-to-peer transfers, allowing you to send money to friends and family instantly. The app also categorizes your transactions automatically, making it convenient to track and analyze your expenses. With its insights feature, you can gain a deeper understanding of your spending patterns and make informed financial decisions.

Key Features:

- Digital Wallet Integration: Link and manage finances across multiple digital platforms

- Contactless Payments: Make secure purchases with a tap of your phone

- Peer-to-Peer Transfers: Send money to friends and family instantly

- Transaction Categorization: Automatically categorize transactions for easy expense tracking

- Insights: Gain a deeper understanding of spending patterns and make informed decisions

PQR Bank Mobile Banking App

PQR Bank's mobile banking app focuses on simplicity and accessibility, providing Android users with a hassle-free banking experience. The app features a minimalist design, ensuring a clutter-free interface that is easy to navigate. It offers a quick balance overview, allowing you to check your account balance at a glance without having to log in. PQR Bank's app also provides an intuitive navigation system, making it effortless to access various banking features and services. One-touch transaction approvals save you time by eliminating the need for multiple steps to complete a transaction. The app also offers a range of customization options, empowering you to tailor the interface to your preferences for a personalized banking experience.

Key Features:

- Minimalist Design: Clutter-free interface for a seamless banking experience

- Quick Balance Overview: Check account balance at a glance without logging in

- Intuitive Navigation: Effortlessly access banking features and services

- One-Touch Transaction Approvals: Complete transactions with a single tap

- Customization Options: Tailor the interface to your preferences for a personalized experience

STU Bank Mobile Banking App

STU Bank's mobile banking app offers a comprehensive suite of banking services for Android users, making it a versatile choice for managing your finances. The app provides an easy and convenient way to apply for loans, enabling you to access funds quickly when needed. STU Bank's app also allows you to manage your credit cards, including viewing statements, making payments, and setting up automatic bill payments. It offers foreign currency exchange services, making it convenient for travelers to convert currencies on the go. Additionally, the app provides personalized financial planning tools, helping you set financial goals, create budgets, and track your progress towards achieving them.

Key Features:

- Loan Applications: Apply for loans conveniently through the app

- Credit Card Management: View statements,make payments, and set up automatic bill payments for credit cards

- Foreign Currency Exchange: Convenient conversion of currencies for travelers

- Personalized Financial Planning: Set financial goals, create budgets, and track progress

VWX Bank Mobile Banking App

VWX Bank's mobile banking app combines banking with social features, enhancing the overall user experience. The app offers peer-to-peer payment options, allowing you to easily send and receive money from friends and family. It also provides a split bill functionality, making it convenient to divide expenses when dining out or sharing costs with others. VWX Bank's app introduces group savings accounts, enabling you to save collectively with others towards a shared goal. The app also provides personalized spending insights, helping you understand your spending habits and identify areas for improvement. With its social features, you can interact with fellow users, share financial tips, and participate in community discussions.

Key Features:

- Peer-to-Peer Payments: Conveniently send and receive money from friends and family

- Split Bill Functionality: Easily divide expenses when dining out or sharing costs

- Group Savings Accounts: Save collectively with others towards a shared goal

- Personalized Spending Insights: Understand spending habits and identify areas for improvement

- Social Features: Interact with fellow users, share financial tips, and participate in community discussions

YZA Bank Mobile Banking App

YZA Bank's mobile banking app is designed with a focus on seamless integration with third-party apps and services. The app allows you to sync your expenses with popular budgeting apps, helping you track and manage your finances effortlessly. It also integrates with digital payment platforms, allowing you to make quick and secure payments using your preferred method. YZA Bank's app provides personalized offers based on your spending patterns, ensuring that you receive relevant discounts and promotions. Additionally, the app offers features such as transaction categorization, making it easier to analyze and understand your spending habits. With YZA Bank's app, you can enjoy a seamless and connected banking experience across various platforms.

Key Features:

- Expense Syncing: Sync expenses with popular budgeting apps for easy tracking

- Integration with Digital Payment Platforms: Make quick and secure payments using preferred methods

- Personalized Offers: Receive relevant discounts and promotions based on spending patterns

- Transaction Categorization: Easily analyze and understand spending habits

In conclusion, the best mobile banking app for Android ultimately depends on your individual needs and preferences. Whether you prioritize security, convenience, investment options, or social features, there is a mobile banking app tailored to meet your requirements. XYZ Bank's mobile banking app offers a user-friendly interface and robust security features, providing a seamless banking experience. ABC Bank's app stands out for its intuitive user experience, mobile check deposit, card management, and personalized insights. DEF Bank's app combines banking and investment services, offering real-time market updates, portfolio management, and financial planning tools. GHI Bank's app emphasizes exceptional security measures, expense tracking, and personalized financial insights. JKL Bank's app focuses on customer satisfaction with a virtual assistant, customer support options, credit score monitoring, and a rewards program. MNO Bank's app caters to tech-savvy users with digital wallet integration, contactless payments, peer-to-peer transfers, and transaction categorization. PQR Bank's app offers simplicity, quick balance overview, intuitive navigation, and one-touch transaction approvals. STU Bank's app provides a comprehensive suite of banking services, including loan applications, credit card management, foreign currency exchange, and personalized financial planning tools. VWX Bank's app combines banking with social features, offering peer-to-peer payments, split bill functionality, group savings accounts, and personalized spending insights. YZA Bank's app focuses on seamless integration with third-party apps and services, offering expense syncing, integration with digital payment platforms, personalized offers, and transaction categorization. With this comprehensive guide, you can make an informed decision and enjoy a hassle-free and efficient banking experience right at your fingertips.